For a significant duration since its establishment, FINCA Tanzania has steadily pursued its primary goal of improving the lives of marginalized low-income individuals who have long been excluded from the traditional financial services sector. This commitment has proven to be a vital lifeline for micro-entrepreneurs across Tanzania. By offering small loans with favorable terms tailored to their specific needs, FINCA Tanzania has successfully bridged the gap in access to capital, thereby bolstering the income and economic prospects of these previously underserved micro-entrepreneurs. This transformative assistance has not only enabled these individuals to send their children to school but has also brought essential necessities within their grasp.

However, the advent of the COVID-19 crisis dealt a severe setback to FINCA’s efforts to improve the quality of life for the low-income community. Group and some individual loans were suspended, and some branches of the bank were closed in a bid to shield the institution from the adverse economic repercussions echoing throughout the world.

Today, the landscape has evolved, and FINCA is reverting to its foundational mission – offering micro and small loans to low-income entrepreneurs. Mr. Edward Talawa, the CEO of FINCA Tanzania, affirms that “the struggle persists without pause or retreat”. He has personally ventured into the field, engaging directly with small entrepreneurs who were once FINCA Tanzania clients. Face-to-face, he listens to their concerns and implores them to return to the fold, to the home that honored them by providing affordable loans and savings accounts, a privilege unattainable from other financial institutions. Meanwhile, he has been promising to immediately address their concerns and pains related to the services of the bank.

Mr. Edward Talawa, CEO of FINCA Tanzania (in white t-shirt) in the field with groups of micro-entrepreneurs

Mr. Frank Chapile, our Tanga Branch Manager, in a local marketplace addressing small entrepreneurs in a bid to reconnect with former clients and onboard new ones.

In a parallel effort, a dedicated refresher training and seminar was recently conducted, gathering all staff of FINCA Tanzania involved in micro loans. Its purpose was to enhance skills and reinforce the primary objective of these loans: to uplift micro entrepreneurs and elevate their quality of life. The training achieved resounding success, infusing Sales Officers with enthusiasm and a renewed dedication to serving small entrepreneurs.

Refresher training of FINCA Sales Officer for the micro loans in session.

Meanwhile, the bank has reviewed the product features of its microloan offerings. These adjustments have made the product more demand-driven and market-responsive. Key changes include reducing the minimum loan amount and relaxing some previously restrictive product features. The processes have been streamlined, resulting in a more efficient product with significantly improved turnaround time and a personalized customer experience.

It is of importance to also note that the recent high-level visit by Dr. John Hatch, the co-founder of FINCA International, Ms. Andrée Simon, President and CEO of FINCA International, and Ms. Cassandra Johnson, the Chief of Staff of FINCA Impact Finance, has rekindled the organization’s spirit and renewed its focus on the founding goals and principles of FINCA. Dr. Hatch stressed the importance of never forgetting the plight of the impoverished.

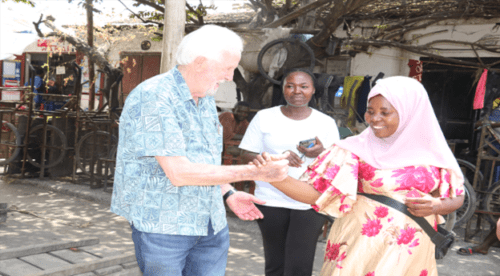

Dr. John Hatch warmly greets a prospective FINCA client with a friendly handshake, while the Branch Manager of the recently reopened Tegeta Branch in Dar es Salaam, Ms. Fausta Lukumay, observes with enthusiasm.

In essence, FINCA Tanzania is taking steps to realign to the core principles that underpinned its establishment, reaffirming its commitment to its original mission.